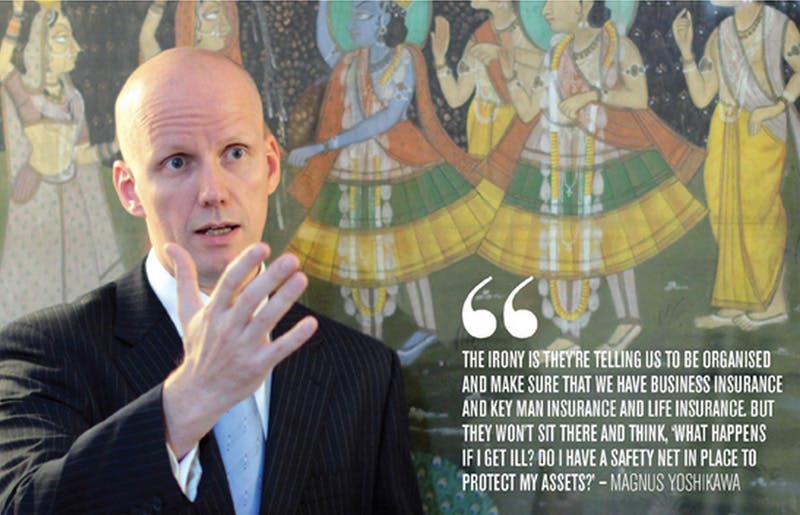

Leon Gettler from Chartered Accountants wrote an article ‘Rescuing a Flatlining Practice”. He interviewed Magnus Yoshikawa, and here is an excerpt of the article –

Maintaining the value of a public practice in the face of rising health risks is becoming a sleeper for the accounting profession. Because just as taxes are inevitable, so are illness and death, writes Leon Gettler.

In the wake of a boom in mergers and acquisitions, valuation experts say they are hearing from more businesses putting themselves up for sale when the principal has either become incapacitated through unforeseen circumstances, or has died. With the average age of public accounting principals in Australia being well over 50 – indeed, there are many in their 60s and 70s still running practices – accountants are a prime risk. Consider this: more than 60 per cent of Australians will be disabled for more than one month, and more than 15 per cent will be disabled for more than three months, during their working life.

Looking at the age of accountants working through to their 70s, the insurance statistics tell us that someone is going to get ill. The problem, experts say, is that the accountants have not managed that risk with insurance and granting powers of attorney.

The result: a $1 million firm is suddenly worth $250,000 when it’s put up for sale. According to research commissioned by the Institute of Chartered Accountants in Australia (the Institute), accountants could be vulnerable to this sort of risk.

The Future of Practice research undertaken by Beaton Research and Consulting, based on the most recent survey of Institute members in public practice, found that almost one in three, or 31.5 per cent, worked more than 50 hours per week, coping with increasing cost pressures and keeping up to date with legislative changes and technical skills – two of the biggest issues they feel are now having an impact on the future of public practice. It also found that 13.1 per cent did not have a retirement plan because they felt younger people were not attracted to small practices, and were not prepared to take on the debt associated with buying a partnership.

The full article can be found on the Chartered Accountants website.